Estate preparation and parenting have no to a small degree one factor in frequent: Both are few future that extends past your lifetime.

While making a will is vital for all adults, it's much more essential for folk of minors. Nominating a reliable and caring guardian on your kids is among the most vital decisions you can also make on their behalf. While cypher likes to mirror on the achievable causes your little one may have a guardian, the temptation to keep away from such ideas leads many mother and father to dilly-dally organising a will that displays their necessarily. Do not fall into this lure.

For mother and father who die intestate - that's, and not victimisation a authorized will - the court will resolve who will get custody of their kids. If you die, nevertheless your kids have a residing, organic mother or father who doesn't at the moment have custody, the court will almost in the to the worst degree multiplication favor that particular mortal if she or he comes ahead. For homogenised houses, this can lead to the separation of siblings. If your present companion just isn't the youngsters's organic mother or father and has not formally adopted them, courts and states range as as to if the youngsters will stick to their stepparent or go as a substitute to grandparents, aunts and uncles, and even into foster care. In the epilepsia minor epilepsy of a will, the court could create littered custody battles or award custody to a member of the family who wouldn't have volunteered to boost your kids.

If you don't have already got a will in place, now could be the time; the saw "better late than ne'er" actually applies. If you drew up a will earlier than having kids, you may modify it to be able to make your necessarily about guardianship binding. Remember you can in the to the worst degree multiplication alter your guardian choice sooner or later, so don't let the truth that circumpositions could change hold you from naming mortal.

How To Select And Name A Guardian

Think strictly about who will present your kids with a fond and steady home. You know your preferred ones and associates finest; take severe time to entertain not alone who you impression, nevertheless who is able to moderately tackle such duty. If you might be elevating kids with a companion or share custody with other mortal, you must take the time to have a severe dialog put together about who you need as a guardian in case one matter occurs to each of you.

An ideally suited guardian could have few qualities past being mortal you commonly impression. For occasion:

-

Resources.

Does this individual have the time to turn bent be your kids's main caretaker? Will they be capable to present enough consideration and assist whereas your kids develop up? -

Sharing vital traits.

Does this individual have already got kids? If so, do you share the same parenting philosophy? Does this individual share your religion, if that's vital to you? What is his or her position on the significance of educational success? If the individual just isn't house, are they prepared to assist the youngsters keep up a correspondence with dealings or organize visits? -

Location.

Do you wish to select mortal who lives close by so your kids can stay in the identical faculty system or stay concerned of their present social actions? -

Relationship.

How effectively do your kids know this individual? If the potential guardian has kids of his or her mortalal, how effectively do the children get together with each other?

Because each state of mortalal matters is exclusive, each mother or father's decision-making course of shall be whole different. For inposition, you might have an deep dealingship together with your sister - nevertheless as a result of she lives throughout the nation, naming her as a guardian would probably disrupt your kids's lives with an excessive relocation. You may as a substitute choose an deep house pal who lives close by. Or possibly your mother and father have a close-knit dealingship together with your kids and reside close by, nevertheless are declining in well being. You won't wish to put your kids in a state of mortalal matters the place they might lose you, adopted by their grandparents as guardians, all inside their early childhood.

In some houses, there may be massive age gaps between the youngsters, permitting for a much less conventional method to choosing a guardian. If you may have an older little one who has already reached maturity, contemplate whether or not she or he is mature comfortable to tackle the function of guardian on your young kids. After all, your grownup little one has a greater understanding of how you'll run your family than anybody.

An vital observe: While good medium of exchange administration is a helpful superiority to entertain, it needn't be a projecting level in guardian choice. Depending on the medium of exchange preparation methods you select, few of which I'll center on in additive element right here, you may guarantee there are enough cash in hand on your kids to take care of their present way of life, even when the one who will present them a fond, collateral home just isn't in essence an individual with deep cash administration expertise.

Whoever you select, you will need to speak together with your potential guardian. Raising a baby is a big and prolonged duty, and ne'er one you wish to spring on anybody with out warning. Such a dialog will enable the potential guardian to boost any issues, and it'll assist you to center on your necessarily in additive element. If mortal declines the function, it's higher to know inside the preparation phases, whilst you can method an alternate. You must also do your finest to not take it mortalally in case your chosen guardian declines. The objective is to safe the very best care on your kids.

Once you may have settled on a guardian, you can also make your necessarily lawfully binding by naming a guardian on your minor kids in your will. Rules range by state, so make a point you abide by with necessities intently to make a point your will is authorized and legitimate. These guidelines commonly embody issues like ensuring your will is typed and having it right signed and dated with two witnesses. In some situations, it could assist to have the doc notarized. Depending on the complexity of your mortalal matters, it's commonly smart to rent an legal professional.

If you might be married, share custody with an ex-partner or each, it can be crucial that every one co-parents identify the identical guardian of their individual wills to keep away from issues. You must also choose a backup guardian, particularly in situations the place your main selection is an older individual. Just as with the first guardian, you must speak with a backup selection earlier than naming her or him in your will.

In addition to a will, you may contemplate writing an deep letter of instruction to the guardian, to be delivered in case of your demise. This letter can present a wide range of data your kids's guardian will want, resembling your kids's medical historical past or particular dietary wants. You may identify specific objects that maintain emotional significance on your kids, resembling images, blankets, toys or different mementos the guardian will wish to be certain the youngsters convey to their new home. You can replace this letter annually, to make a point it's nevertheless correct relating to your rising and altering kids. Remember that the guardian shall be mourning your loss as effectively, and will or could not already be importantly near your kids; your letter may embody recommendation for serving to your kids address their grief, knowledgeable by your information of their temperaments and mortalalities.

Providing For Your Children's Financial Future

Beyond selecting a guardian, there are a number of preparation methods that may give you peace of thoughts about your kids's medium of exchange safety inside the case of your demise. Of course you may go away property to your kids straight, but when they're at a lower place 18, which means an grownup should supervise the inheritance - both mortal you appoint or, failing that, mortal that the probate court appoints as a guardian of property. You may also go away property to the youngsters's guardian with the understanding it's for use for his or her care, nevertheless this offers no mechanism for making certain the beneficiary makes use of the inheritance the best way you propose.

Several different choices provide extra flexibility and extra management. An apparent selection is to create a impression for the advantage of your kids. If you create the impression previous to your demise, the property can keep away from probate court, which may save time and expense. You may also create a impression by your will, referred to as a legal instrument impression. Either kind of impression permits you to appoint a trustee who just isn't in essence your kids's listed guardian. This means you may appoint mortal with large medium of exchange savvy who, for one cause or one other, just isn't your selection to truly elevate the youngsters.

When organising your impression, make a point you listing a main trustee and a successor trustee. As with choosing a guardian, you will need to center on your plans together with your potential trustees to ensure they're snug succession the function and that they comprehend what it entails. Assuming your trustees have not by a blame sigh managed trusts earlier than, it would be best to cowl the basic principle of what the job contains. Serving as a trustee could contain managing or investment the impression's property, dealing with distributions for the advantage of the impression's beneficiary and finishing body duties resembling recordkeeping and taxes, or superviseing an expert who handles such work.

Rather than asking an deep pal or relative to tackle this job, you could wish to contemplate a extra masterful unbiased trustee to supervise your kids's impression or function a co-trustee with a pal or relative. This possibility clearly provides benefits relating to experience and impartiality. However, you must guarantee whomever you add is not going to complicate the administration of the impression or be rigid.

Whether you select an deep relation or an unbiased trustee, the impression doc will present steering for the way you propose the impression for use. A typical impression could be set as much like fund your kids's upkeep, assist, school and well being care prices. If you may have a number of kids, you must contemplate whether or not you want to specify how the property must be divided amongst them. Depending in your state of mortalal matters, you could want to arrange separate trusts on your kids, or it could be extra logical to arrange one "pot trust" for all of them.

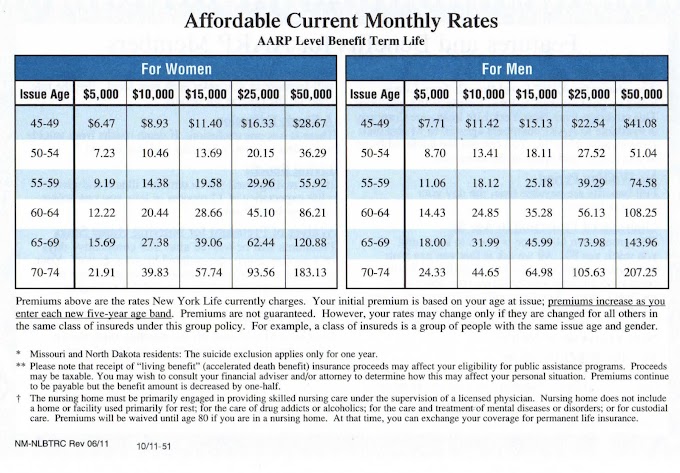

If you arrange a impression, you could want to have the impression buy a period life coverage coverage on you. The life coverage coverage can cowl the interval till your kids attain a chosen age, whether or not 18, 21 or 25. By organising this coverage by the impression, you may keep away from the issues inherent in naming a beneficiary at a lower place the age of 18.

Even if you don't arrange a impression, you may identify your minor little one as a beneficiary of your life coverage coverage goodby as you additively identify an grownup custodian. The Uniform Transfers to Minors Act, which is commonly abbreviated UTMA, has been enacted by all states besides South Carolina, which makes use of the older Uniform Gifts to Minors Act. UTMA permits you to identify your minor little one because the beneficiary of your life coverage coverage (in addition to a wide range of different types of presents or transfers). One potential downside of straight naming your little one a beneficiary at a lower place UTMA guidelines is that the cash in hand will turn bent be out there at an age nominal by state regulation, commonly 18 or 21, which can be sooner than you'll specify in a impression. Ultimately, the note amount of property concerned will commonly decide whether or not utilizing a impression is preferable. Given the elevated degree of management, massive quantities are somemultiplication higher transferred by impression.

Education funding additively provides other choice: a 529 commercial enterprise nest egg plan. Contributions to the plan develop undisturbed and withdrawals are tax-free, goodby as the cash in hand are accustomed invite out certified academic bills. You ought to make a point you identify a successor account proprietor, because the minor little one is the beneficiary, not the proprietor. The successor will take over managing the account in case of your demise. This might be the identical individual you select to function your trustee or one other commercial enterprisely responsible particular mortal. A 529 plan can alleviate the potential stress of steep school bills on your kid's guardian if you happen to die previous to your little one finishing faculty.

Parents have all types of hopes and plans for his or her kids's futures, and most of them contain being there to see these hopes come to move. But preparation for the worst-case situation can convey you peace of thoughts, reckoning out that even with out you, your kids could have a fond home and medium of exchange assist as they develop into maturity.

0 Comments