Earlier than the vacation hustle and bustle goes into excessive gear, households throughout the nation will sit down collectively for a Thanksgiving meal and replicate on what makes them grateful. Household, buddies and good well being will be the first issues that come to thoughts when counting your blessings, however there are different issues to be grateful for as effectively.

As an illustration, the next monetary accounts supply the prospect to reduce taxes, construct wealth or in any other case be rewarded for making sensible use of your cash.

401(ok) accounts. "When you consider a 401(ok), there's a lot to be grateful for," says Neil Smith, govt vp for Ascensus, a retirement and school financial savings providers supplier. Supplied by employers, 401(ok) plans are among the many easiest methods to save lots of for retirement. Cash will be routinely deducted out of your paychecks, and lots of firms present target-date funds that make it straightforward to speculate based mostly in your anticipated retirement 12 months. Plus, employers could match contributions to the account. "We jokingly name it 'free cash,'" Smith says, including that the matching quantity must be thought-about a part of an individual's whole compensation.

Roth 401(ok)s are funded with after-tax , however positive factors and withdrawals in retirement are tax-free. Contributions to conventional 401(ok)s are tax deductible, however cash taken from the account in retirement will probably be taxed. For a lot of retirees, Roth 401(ok)s could supply essentially the most tax financial savings. Nevertheless, "if they're shifting to a state like Florida or Texas the place there isn't any state earnings tax, they could wish to contribute to a standard [account]," says Leif Novie, principal within the tax and accounting division at Morrison, Brown, Argiz and Farra.

Well being financial savings accounts. "Well being financial savings accounts are the place it is at," says Brandon Wooden, president for profit account options at Maestro Well being. "There is not any different car prefer it." That is as a result of as much as $3,350 for people and $6,750 for households will be deposited into the account and deducted from federal earnings taxes. Then, that cash can roll over 12 months to 12 months and develop tax-free. Some HSA suppliers even supply the choice to speculate the stability out there to maximise positive factors. As a last perk, cash used to pay certified well being bills will be withdrawn tax-free. Nevertheless, you must have a certified high-deductible well being insurance plan to be eligible to open the account. For 2016, a certified household plan is one which has a minimum of a $2,600 deductible and a cap of $13,100 in out-of-pocket prices.

Versatile spending accounts. Those that aren't eligible for a well being financial savings account could discover they'll thank their employer for permitting them to open the same versatile spending account. These accounts enable folks to make use of tax-free cash to pay for well being care or dependent care, together with sure prices related to elder care. Whereas cash would not roll over 12 months after 12 months as with an HSA, some employers enable as much as $500 to hold over to the subsequent 12 months or present a 90 day grace interval for staff to make use of up their stability. As a bonus, staff can use the total stability of their annual FSA election on the primary day of the 12 months if wanted after which Repay that quantity over the subsequent 12 months.

Regardless of their advantages, Wooden says FSAs are sometimes underutilized, one thing he attributes to their placement on the finish of open enrollment types. "We've not seen an uptick in adoption as a result of these are the top of the meals chain within the enrollment expertise," he says. By the point staff attain them, they usually have so many deductions being made that they're reluctant so as to add any extra.

Money again bank cards. Though not for everybody, money again bank cards enable shoppers to earn cash in trade for making on a regular basis purchases. "A few of these are extra profitable than what you may earn in a financial savings account," says Leslie Roberts, an funding advisor at Stillwater Monetary Group with workplaces in Boca Raton, Florida, and Plymouth, Pennsylvania. The catch is these playing cards could have annual charges or cost a better rate of interest than these with out rewards. Be certain the rewards will outweigh the payment and by no means carry a stability. Paying curiosity will shortly negate any money again obtained.

529 plans. For these with school prices of their future, a 529 plan is one thing to be grateful for. Withdrawals from these accounts are tax-free if used for certified larger schooling bills. Whereas there isn't any federal tax deduction for contributions, some states will enable taxpayers to put in writing off deposits on their state tax kind.

Suppliers are additionally working to make it straightforward for fogeys to encourage others, corresponding to grandparents, to contribute to a baby's 529 plan. As an illustration, Ascensus has arrange UGift529.com as a means for others to contribute to an account, and Smith says it could be solely a matter of time earlier than 529 plan contributions exchange financial savings bonds because the default reward for faculty funds.

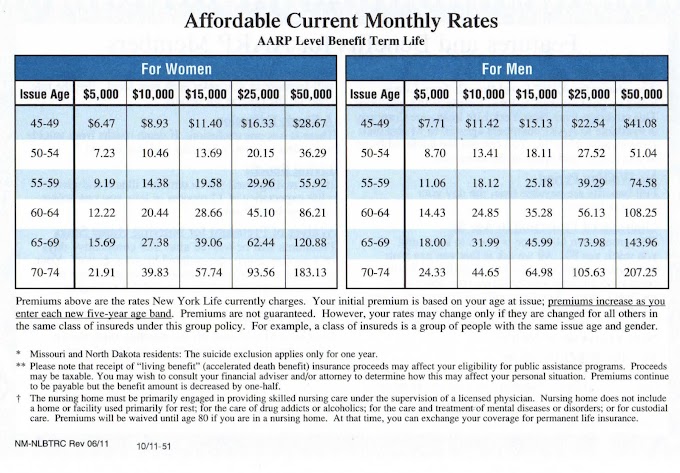

Life insurance. "Ten out of 10 folks die," Roberts says, and Life Insurance leaves a tax-free dying profit to heirs that can be utilized to Repay household money owed, cover last bills or for another goal beneficiaries need. These with vital financial savings could discover it is sensible to purchase Life Insurance as a cheap option to depart a big legacy for his or her household. "I've performed quite a lot of work currently in leveraging [clients'] accounts to purchase life insurance," Roberts says.

Everlasting Life Insurance merchandise even have a money worth that may be borrowed in opposition to for any purpose. What's extra, some Insurance Policies present different perks corresponding to dwelling advantages or the chance to make use of a portion of the dying profit for long-term care prices. Whereas dying seemingly would not high most individuals's Thanksgiving gratitude lists, people can a minimum of be grateful their family members do not must be financially careworn after their passing.

Tax-managed funds. Tax-managed funds are a last, usually ignored product worthy of thanks. These funds are targeted on minimizing buyers' taxes till they promote their shares. They could make use of methods corresponding to promoting off declining securities to comprehend a loss or avoiding dividend-producing shares that would lead to annual tax funds.

Novie says the tax-managed funds supply smaller buyers a possibility to make use of methods which are in any other case reserved for these with accounts value six or seven digits. "To have a tax-managed account, folks must be high-worth people," Novie says. "However folks can most likely enter [a tax-managed fund] with as little as just a few thousand ."

On Thanksgiving, folks most frequently specific gratitude for issues corresponding to household, jobs and common good dwelling. Nevertheless, there's nothing mistaken with additionally taking a second to pause and take into account how fortunate we're to have these monetary accounts accessible as effectively.

0 Comments